Starting a business is an exciting journey. But it involves many legal steps.

Understanding the legal requirements for starting a business is crucial. These steps your business is legally compliant and ready for success. From registering your business name to obtaining the necessary licenses, there are several important tasks to complete. You need to consider the right business structure and understand tax obligations.

Navigating these requirements may seem daunting, but it is essential for your business’s stability and growth. Knowing these legal steps not only keeps you on the right side of the law but builds a strong foundation for your business. Let’s explore these requirements to help you start your business with confidence. For more details

Choosing A Business Structure

Choosing the right business structure is a step for any new business owner. The structure you choose will impact your legal obligations, taxes, and personal liability. Each business structure has unique features that may suit your needs better.

Types Of Business Entities

There are several types of business entities to consider. The most common include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each has specific characteristics and legal implications.

Pros And Cons Of Each Structure

Sole proprietorships are the simplest form. They are easy to set up and offer complete control to the owner. But, they come with unlimited personal liability.

Partnerships involve two or more people. They share responsibility and profits. Partnerships are relatively easy to establish. Yet, partners are personally liable for business debts.

LLCs combine elements of partnerships and corporations. They offer limited liability protection. LLCs provide flexibility in management and tax benefits. On the downside, they can be more complex and costly to maintain.

Corporations are separate legal entities. They offer strong liability protection. Corporations can raise capital more easily. But they are subject to double taxation and stricter regulations.

Registering Your Business Name

Registering your business name is a crucial step in starting a business. Your business name represents your brand and identity. It is how customers will recognize and remember you. Ensuring your business name is unique and officially registered is key to establishing your presence in the market.

Importance Of A Unique Name

A unique business name sets you apart from competitors. It helps avoid confusion among customers. It protects your brand legally. A unique name no other business can legally use your name. This protects your reputation and prevents legal disputes.

Steps To Register

First, choose a name that reflects your business. it is easy to remember and spell. Next, check if the name is available. You can do this through a business name search online. Most countries have an official database for this purpose.

Once you confirm the name is available, register it with the appropriate government agency. This process may vary by country. Often, it involves filling out a form and paying a fee. You may need to provide details about your business and its owners.

After registering, you will receive a certificate or confirmation. This document proves your business name is legally recognized. Keep this document safe. You may need it for opening a bank account or applying for licenses.

credit: www.upmetrics.com

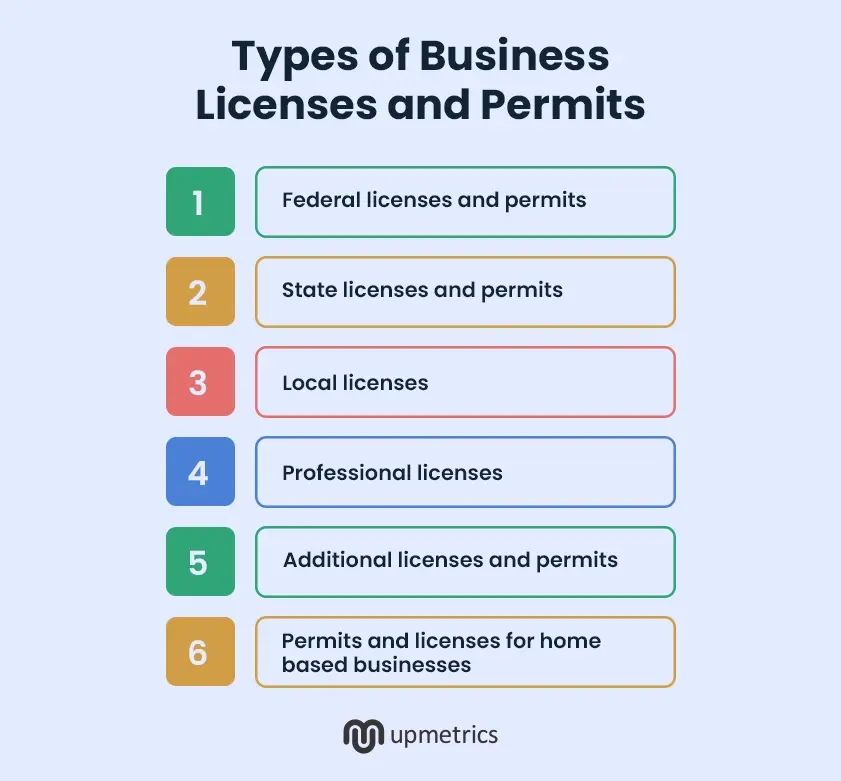

Obtaining Business Licenses And Permits

Starting a business can be exciting. But, you must meet legal requirements. Obtaining the right licenses and permits is crucial. These you operate legally and avoid fines. This section covers the types of licenses you need and the application process.

Types Of Licenses Needed

The type of business license depends on your industry. Common licenses include general business licenses. These are needed by most businesses. Professional licenses are for specific jobs like doctors or lawyers. Health permits are necessary for food-related businesses. Retailers may need sales tax permits. Home-based businesses might need zoning permits. Always check local regulations.

Application Process

Applying for a business license is straightforward. First, gather your business information. This includes your business name, address, and owner details. Next, complete the application form. Forms are often available online. Pay the required fee. Fees vary based on your location and business type. Submit your application to the appropriate authority. This could be a local, state, or federal office. Wait for approval. Processing times can vary. Some licenses take days, others weeks. Once approved, display your license prominently. Keep it up to date. Renew it as required by law.

Credit: www.equitynet.com

Understanding Tax Obligations

Starting a business comes with many responsibilities. One of the most important is understanding your tax obligations. Knowing the different types of taxes will help you stay compliant and avoid penalties.

Federal Taxes

Your business must pay federal taxes. These taxes include:

- Income tax: You pay this tax on your business’s profits.

- Self-employment tax: This tax covers Social Security and Medicare.

- Employment taxes: These include Social Security, Medicare, and federal income tax withholding.

Each type of tax has its own forms and deadlines. Be sure to keep accurate records and file on time.

State And Local Taxes

In addition to federal taxes, you may need to pay state and local taxes. These can vary widely by location. Some common state and local taxes are:

- State income tax: Some states have their own income tax systems.

- Sales tax: If you sell goods or services, you may need to collect sales tax.

- Property tax: If you own property, you may owe property tax.

Check with your state’s tax authority to understand your obligations. Some local governments have their own taxes. Keep track of these to avoid surprises.

Setting Up Business Banking

Setting up a business bank account is crucial. It helps separate personal and business finances. This separation simplifies accounting and tax filing, it builds a professional image for your business. Here

Choosing A Bank

Choosing the right bank is important. Consider these factors:

- Fees: Look for banks with low or no fees.

- Location: Choose a bank with branches close to you.

- Services: The bank offers the services you need.

- Online Banking: Check if the bank has a good online banking system.

- Reputation: Research the bank’s reputation for customer service.

Necessary Documentation

To open a business bank account, you will need to provide documentation. Here is a list of common documents:

- Personal Identification: A government-issued ID, such as a driver’s license or passport.

- Employer Identification Number (EIN): This is issued by the IRS.

- Business License: Proof that your business is registered.

- Partnership Agreement: If your business is a partnership, you will need this.

- Articles of Incorporation: Necessary for corporations.

- Operating Agreement: Required for LLCs.

Make sure all your documents are up-to-date. This will streamline the account opening process. With the right bank and proper documentation, setting up your business banking will be smooth.

Credit: www.linkedin.com

Complying With Employment Laws

Starting a business involves more than just a great idea and funding. Complying with employment laws is crucial for the success and legality of your business. These laws protect both employers and employees, ensuring fair treatment and a safe working environment.

Hiring Employees

Hiring employees means understanding the legal requirements for recruitment. Legal Requirements You need to follow anti-discrimination laws. This fairness in the hiring process. Create clear job descriptions. These should outline duties and required qualifications. Perform background checks legally. This protects your business from potential risks.

Employee Rights And Benefits

Employees have rights that you must respect. They deserve a safe workplace. Provide necessary training for safety protocols. Offer fair wages according to labor laws. that work hours and overtime are correctly recorded and compensated. Employees are entitled to benefits. These include health insurance, paid leave, and retirement plans. Understand and comply with state and federal laws regarding these benefits. This keeps your business in good standing and your employees satisfied.

Ensuring Business Insurance

Ensuring business insurance is crucial for protecting your company from unexpected events. It covers various risks, such as property damage, legal claims, and employee injuries. Without proper insurance, your business might face financial difficulties. Let’s explore the types of insurance you might need and how to obtain them.

Types Of Insurance

There are several types of insurance to consider for your business. Legal Requirements General liability insurance covers bodily injury and property damage. It protects against claims of negligence. Another important type is property insurance. It safeguards your business’s physical assets, like buildings and equipment.

Workers’ compensation insurance is essential if you have employees. It covers medical costs and lost wages due to work-related injuries. Professional liability insurance, known as errors and omissions insurance, is vital for service-based businesses. It protects against claims of mistakes or inadequate work.

How To Obtain Insurance

To obtain business insurance, start by assessing your risks. Identify the specific risks your business faces. Then, research insurance providers. Compare their offerings and read reviews. Choose a provider with a good reputation and fair pricing.

Contact the selected insurance provider. Discuss your business needs with an agent. They will guide you through the process. Fill out the necessary forms and provide required documents. Review the policy terms carefully. you understand what is covered and excluded.

Once you agree on the terms, sign the policy. Pay the premium to activate your coverage. Keep your insurance documents safe. Review your coverage regularly. Adjust it as your business grows and changes. For more

Maintaining Business Records

Maintaining business records is crucial for every business owner. Good record-keeping compliance with legal requirements. It provides a clear picture of your business’s financial health. Organized records help during tax season and can save time and stress. Below, we explore the key aspects of maintaining business records.

Record-keeping Requirements

Every business must keep accurate records of income and expenses. This includes receipts, invoices, and bank statements. Legal requirements vary by country and industry. Most require records to be kept for at least five years. Not keeping proper records can lead to fines or legal issues.

Employee records are essential. Keep information on hiring, payroll, and performance. these records are secure and confidential. This helps in complying with labor laws.

Best Practices

Organize records in a systematic way. Use folders or digital storage to keep everything in order. Label files clearly for easy access. Regularly update your records to avoid last-minute stress.

Use accounting software to simplify the process. Many tools can automatically track income and expenses. This reduces the risk of errors and saves time. Backup your digital records to prevent data loss.

Review and reconcile your records monthly. This helps in catching errors early. It that your records are accurate and up-to-date.

Seek professional help if needed. An accountant can provide valuable advice and help maintain compliance. They can assist with financial planning and tax filing.

Proper record-keeping is not just a legal requirement. It is a key part of running a successful business. Follow these best practices to stay organized and compliant.

Credit: www.freshbooks.com

Frequently Asked Questions

What Are The First Steps To Start A Business?

The first steps include choosing a business structure, registering your business name, and obtaining necessary licenses and permits.

Do I Need A Business License?

Yes, most businesses require a license. Requirements vary by location and industry, so check local regulations.

How Do I Register My Business Name?

You can register your business name through your state or local government’s website. Check for availability first.

What Taxes Do New Businesses Need To Pay?

New businesses typically need to pay income, employment, and sales taxes. Consult a tax professional for specific obligations.

Conclusion

Starting a business involves understanding legal requirements. These rules protect your business and customers. Research and follow local laws. Register your business name and structure. Obtain necessary licenses and permits. compliance with tax obligations. Understanding legal steps helps avoid future problems.

Simplify the process by seeking professional advice. A lawyer or accountant can provide valuable assistance. Stay informed and updated on regulations. Proper planning leads to a smoother business journey. Make legal compliance a priority for long-term success. Your business foundation depends on these crucial steps.