Managing small business finances can be tricky. But it’s essential for success.

Running a small business involves many challenges. One of the biggest is handling finances. Good financial management helps your business grow. It prevents cash flow problems. Many small business owners struggle with this. They might lack financial expertise. Or, they could be too busy with other tasks.

Understanding how to manage finances can reduce stress. It can improve decision-making. If you’re unsure where to start, learning how to create an expense sheet for a small business can be a great first step.

This blog will guide you through the basics. You’ll learn simple strategies to keep your finances to complete. Whether you’re new to business or experienced, these tips will help. Let’s dive in and make managing finances easier for you.

credit: www.invoiceowl.com

Setting Financial Goals

Setting financial goals is crucial for any small business. These goals help you plan and manage your finances effectively. They provide a clear direction and help measure your progress. Let’s break down financial goals into short-term and long-term categories.

Short-term Goals

Short-term goals are those you aim to achieve within a year. They are essential for daily operations and cash flow management. Here are some examples:

- Paying off small debts

- Increasing monthly sales by 5%

- Reducing overhead costs by 10%

- Building a cash reserve

To track these goals, create a simple table:

| Goal | Target Date | Status |

|---|---|---|

| Pay off small debts | 6 months | In Progress |

| Increase sales by 5% | 3 months | Not Started |

| Reduce overhead costs by 10% | 1 year | In Progress |

| Build cash reserve | 9 months | Not Started |

Long-term Goals

Long-term goals are those set for over a year. These goals focus on the growth and sustainability of your business. Examples include:

- Expanding to new markets

- Buying new equipment

- Increasing overall revenue by 25%

- Opening a new branch

Use an ordered list to prioritize these goals:

- Increase overall revenue by 25%

- Expand to new markets

- Buy new equipment

- Open a new branch

Setting both short-term and long-term goals keeps your business on track. It helps you manage finances wisely. Regularly review and adjust these goals to stay aligned with your business growth.

Credit: www.invoiceowl.com

Budgeting Basics

Managing small business finances can be challenging. Budgeting is crucial for success. It helps you control spending, plan for the future, and stability. Let’s go into budgeting basics to help you manage your finances better.

Creating A Budget

Start by listing all sources of income. Include sales, investments, and other revenue streams. Next, list your expenses. Divide them into fixed costs like rent, and variable costs like utilities. Estimate these costs accurately. Use historical data to help you.

Set financial goals. Decide how much you want to save or invest. Allocate funds for emergencies. This creates a financial safety net. Review your budget regularly. Adjust it to reflect changes in your business. A flexible budget keeps you on track.

Tracking Expenses

Track every expense. Keep receipts and invoices organized. Use accounting software for accuracy. This helps you see where your money goes. Analyze spending patterns. Identify areas where you can cut costs. Reducing unnecessary expenses boosts your profit.

Record expenses daily. This prevents small costs from being forgotten. Regular tracking helps you stay within budget. It makes tax preparation easier. Staying organized reduces stress during tax season.

Managing Cash Flow

Effective cash flow management is vital for small business success. Cash flow refers to the money coming in and going out of your business. Properly managing it your business can cover expenses and invest in growth. Let’s explore key strategies to manage cash flow better.

Monitoring Inflows And Outflows

Start by tracking all money coming into your business. This includes sales, investments, and loans. Record every transaction meticulously. Use accounting software to keep records up-to-date. Regularly review these records to identify patterns.

Next, monitor your outflows. List all expenses, such as rent, salaries, and supplies. Categorize expenses to understand where your money goes. This helps in identifying areas to cut costs. Keep a close eye on bills and due dates to avoid late fees.

Improving Cash Flow

Improving cash flow begins with invoicing promptly. Send invoices as soon as work is completed. Consider offering discounts for early payments to encourage faster settlements.

Negotiate better terms with suppliers. Try to extend payment terms without affecting relationships. This gives you more time to manage your cash.

Lastly, consider short-term financing options. A small business line of credit can provide a safety net during tough times. Use it wisely to cover unexpected expenses without disrupting operations.

Credit: www.invoicera.com

Bookkeeping Essentials

Managing finances is a critical aspect of running a small business. It that your business stays on track and is financially healthy. Bookkeeping is the backbone of this process. It involves recording all financial transactions and keeping track of your income and expenses. Here are some essential tips to help you get started with bookkeeping.

Choosing Software

First, you need to choose the right bookkeeping software. This software will help you track your financial transactions efficiently. There are many options available, each with unique features. Here are some popular choices:

- QuickBooks

- FreshBooks

- Xero

- Wave

- Billed

Each of these software options has its pros and cons. Consider your business needs and budget before making a choice. QuickBooks is great for comprehensive accounting needs. FreshBooks is ideal for service-based businesses. Xero offers excellent integration with third-party apps. Wave is a good free option for small businesses.

Recording Transactions

Once you have chosen your software, it’s time to record your transactions. Make it a habit to update your records daily or weekly. This will help you keep track of your cash flow and avoid any surprises.

Here are some steps to follow:

- Collect all receipts and invoices.

- Enter them into your bookkeeping software.

- Reconcile your bank statements with your records.

- Check for any discrepancies and correct them.

Keeping your records up to date is crucial. It helps you make informed decisions and prepares you for tax season. , it gives you a clear picture of your business’s financial health.

In summary, choosing the right software and recording transactions regularly are key to effective bookkeeping. These steps will help you manage your small business finances better.

credit: www.upmetrics.com

Tax Preparation

Tax preparation is a crucial part of managing small business finances. Proper tax management can save you money and prevent legal issues. It involves understanding your tax obligations and filing taxes accurately.

Understanding Tax Obligations

As a small business owner, you must know your tax obligations. These include federal, state, and local taxes. Each has its own rules and deadlines.

First, identify the type of taxes you need to pay. These may include:

- Income Tax: Tax on your business profits.

- Self-Employment Tax: Covers Social Security and Medicare.

- Employment Tax: For businesses with employees.

- Sales Tax: Applies if you sell products or services.

Next, determine your tax rate. This depends on your business structure. Sole proprietors, partnerships, and corporations have different rates.

Filing Taxes

Filing taxes accurately is essential. It involves gathering financial documents and completing tax forms.

Follow these steps to file your taxes:

- Collect Financial Records: Gather income, expense, and deduction records.

- Choose the Right Forms: Select forms based on your business type.

- Fill Out the Forms: Enter information accurately. Double-check for errors.

- Submit On Time: Meet deadlines to avoid penalties.

Consider using tax software or hiring a tax professional. They can help accuracy and compliance.

| Type of Tax | Form Needed | Due Date |

|---|---|---|

| Income Tax | Form 1040 | April 15 |

| Self-Employment Tax | Schedule SE | April 15 |

| Employment Tax | Form 941 | Quarterly |

| Sales Tax | Varies by state | Varies by state |

Stay organized and keep track of your deadlines. Proper tax preparation will help your business thrive.

Credit: www.rippling.com

Securing Financing

Securing financing is crucial for managing small business finances. Whether you’re starting or expanding, having access to funds is essential. Understanding the different types of financing and knowing how to apply for loans can make a significant difference.

Types Of Financing

There are various types of financing available for small businesses. Choosing the right one depends on your needs and financial situation.

One option is a business loan from a bank or credit union. These loans usually offer lower interest rates but require a strong credit history.

Another option is a line of credit. This allows you to borrow as needed, up to a certain limit. It provides flexibility in managing cash flow.

For quicker access to funds, consider online lenders. They often have faster approval processes but may charge higher interest rates.

Grants are another source of financing. These are funds you don’t need to repay. They are usually offered by government agencies or private organizations.

Lastly, look into venture capital or angel investors. These investors provide funding in exchange for equity in your business.

Applying For Loans

Applying for a loan can be a detailed process. Preparation is key to a successful application.

First, gather all necessary documents. These usually include business plans, financial statements, and tax returns. Having these ready speeds up the process.

Next, check your credit score. A higher score increases your chances of approval and better terms.

Then, research different lenders. Compare interest rates, terms, and requirements. Choose the one that best fits your needs.

Fill out the application form accurately. Provide all requested information and double-check for errors.

Submit your application and wait for the lender’s decision. This can take a few days to a few weeks.

Finally, if approved, review the loan agreement carefully. Understand the terms and conditions before signing.

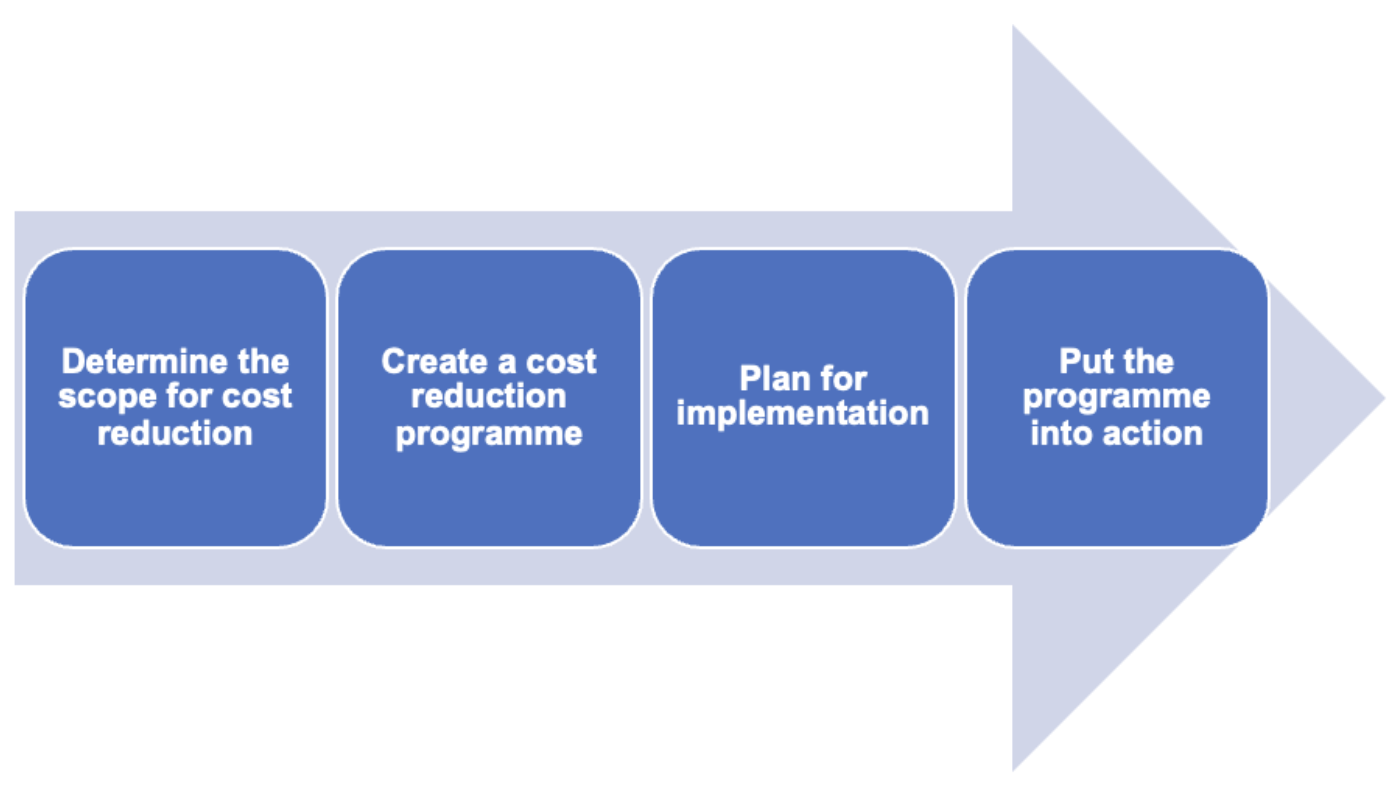

Cost Reduction Strategies

Managing finances is crucial for the success of any small business. One of the most effective ways to improve your bottom line is by implementing cost reduction strategies. This section will explore some practical approaches to help you cut costs and increase profitability.

Identifying Unnecessary Costs

The first step in reducing costs is to identify and eliminate unnecessary expenses. Start by reviewing all your financial statements. Look for recurring charges that may not be essential to your operations. Consider the following tips:

- Audit Subscriptions: Cancel unused or duplicate subscriptions.

- Energy Efficiency: Adopt energy-saving practices to lower utility bills.

- Office Supplies: Buy in bulk and use reusable items.

Negotiating With Suppliers

Another effective cost reduction strategy is to negotiate better terms with your suppliers. Strong relationships with suppliers can lead to significant savings. Here are some strategies:

- Bulk Orders: Negotiate discounts for large orders.

- Payment Terms: Ask for extended payment terms to improve cash flow.

- Alternative Suppliers: Compare prices and switch if necessary.

By focusing on these cost reduction strategies, you can improve your financial health and long-term success.

Financial Reporting

Financial reporting is crucial for small business success. It helps you track income, expenses, and overall financial health. With proper financial reporting, you can make informed decisions. This your business grows steadily.

Creating Financial Statements

Creating financial statements is the first step in financial reporting. These statements include the balance sheet, income statement, and cash flow statement. The balance sheet shows your business’s assets, liabilities, and equity. The income statement highlights revenue, expenses, and profits over a specific period. The cash flow statement tracks cash inflows and outflows.

To create these statements, gather all financial data. Use accounting software to simplify the process. accuracy to avoid future issues. Regularly update these statements to reflect your business’s current financial status.

Analyzing Financial Data

Analyzing financial data helps you understand your business’s performance. Look for trends in revenue and expenses. Identify areas where you can cut costs or increase income. Compare your financial data to industry benchmarks. This shows how your business stacks up against competitors.

Use financial ratios to evaluate performance. Common ratios include the current ratio, debt-to-equity ratio, and gross profit margin. These ratios provide insights into liquidity, leverage, and profitability. Regular analysis allows you to adjust strategies and improve business performance.

Frequently Asked Questions

How Can I Budget For My Small Business?

Creating a budget helps track expenses and revenue. Start by listing all income sources and fixed costs. Adjust for variable expenses. Regularly review and update your budget to financial stability and growth.

What Are The Best Financial Tools For Small Businesses?

Utilize accounting software like QuickBooks or Xero. These tools help manage invoicing, expenses, and payroll. They provide insightful financial reports. They simplify tax preparation and compliance with financial regulations.

How Do I Manage Cash Flow Effectively?

Monitor cash flow regularly to avoid shortages. Use cash flow statements to track income and expenses. timely invoicing and follow-up on payments. Consider maintaining a cash reserve for emergencies.

What Financial Statements Should I Track?

Track essential financial statements like the balance sheet, income statement, and cash flow statement. These documents provide a clear picture of your business’s financial health. Regularly reviewing them helps in making informed decisions.

Conclusion

Managing small business finances can seem tough, but it’s doable. Keep track of expenses.Create an expense sheet to organize and monitor your spending effectively. Create a budget and stick to it. Use accounting software to simplify tasks. Small Business Finances Seek professional advice when needed. Stay organized and review financial records regularly. These steps will help maintain financial health.

A well-managed budget business growth. Stay disciplined and watch your business thrive.