Avoiding losses in the stock market is crucial for financial health. It requires smart strategies and careful planning.

The stock market can be unpredictable. Many investors face the risk of losing their hard-earned money. But, with the right approach, you can minimize these risks. Understanding market trends, diversifying investments, and setting clear goals are steps. This guide will explore practical tips to help you avoid losses and protect your investments.

By being informed and cautious, you can navigate the stock market with confidence. Let’s go into the strategies that can help you maintain a healthy portfolio.

Credit: www.goodreads.com

Research And Education

Effective research and education are crucial to avoiding losses in the stock market. Knowing how to find and use the right information helps in making smart investment choices. Let’s explore how understanding market trends and learning from experts can make a difference.

Understanding Market Trends

Understanding market trends is key. Trends show how the market is moving. They help predict future changes. Study past market data. See how stocks reacted to different events. This helps in making better decisions.

Look at financial news. Follow market analysts. They provide insights into market movements. Knowing current trends helps in identifying good investment opportunities.

To take your research a step further, using the right platform for stock analysis can significantly enhance your understanding of market movements. For recommendations on the best platforms for stock analysis, check out this detailed review on Which Platform Is Best for Stock Analysis?.

Learning From Experts

Experts have years of experience. They know the market well. Reading their books can be helpful. Attend their seminars. Listen to their podcasts. They share valuable tips.

Join investment groups. Engage in discussions with experienced investors. Their advice can help you avoid common mistakes. Learning from their experiences can save time and money.

Credit: www.amazon.com

Diversification

Diversification is one of the key strategies to avoid losses in the stock market. It involves spreading your investments across various assets. This way, you reduce the risk of losing everything if one investment fails. Let’s explore how diversification can help you stay safe in the stock market.

Spreading Investments

Spreading investments means putting your money in different stocks, bonds, and sectors. Don’t put all your money into one stock. If that company fails, you lose everything. But if you invest in many companies, one failure won’t hurt as much. You can invest in different sectors. Technology, healthcare, and finance are examples. This way, if one sector struggles, others may still perform well.

Balancing Risk

Balancing risk is another part of diversification. Some investments are safer but offer lower returns. Bonds are an example. They are stable but grow slowly. Stocks can give higher returns but are riskier. By mixing both, you balance risk and reward. You can consider international investments. Different countries’ economies perform differently. This adds another layer of safety. Diversification helps you manage risk aiming for good returns.

Risk Management

Investing in the stock market can be profitable. Yet, it comes with risks. To avoid losses, understanding risk management is crucial. This involves strategies to protect your investments. Let’s explore key methods for managing risk effectively.

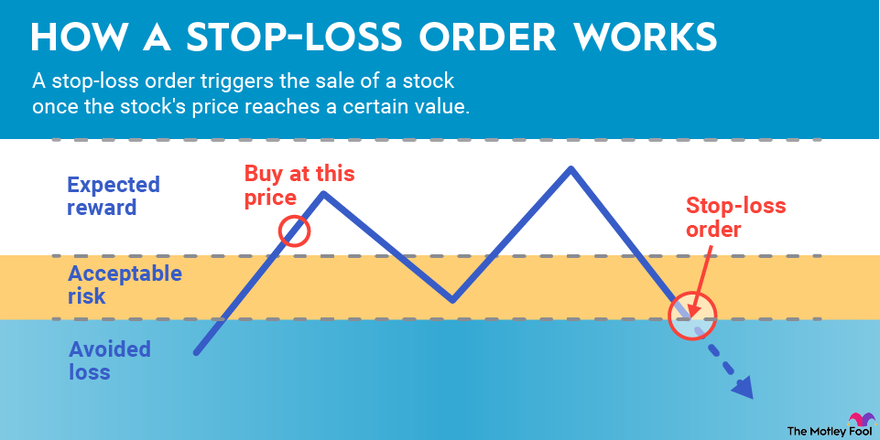

Setting Stop-loss Orders

A stop-loss order helps control losses. It automatically sells a stock when it reaches a certain price. This prevents further decline. Setting a stop-loss order is simple:

- Decide on a stop-loss price.

- Place the order with your broker.

- Monitor your investment regularly.

Stop-loss orders protect your investments. They you don’t lose more than you can afford.

Evaluating Risk Tolerance

Understanding your risk tolerance is. It defines how much risk you can handle. Evaluate your risk tolerance by considering these factors:

- Age: Younger investors can take more risks.

- Financial Goals: Short-term goals need safer investments.

- Investment Experience: More experience allows for higher risk.

- Comfort Level: Invest only in what makes you comfortable.

Creating a balance between risk and reward is key. Knowing your risk tolerance helps in making informed decisions.

Long-term Perspective

Investing in the stock market can be risky. But having a long-term perspective can help you avoid losses. It involves patience and discipline. It means holding onto investments for years, even decades. This approach allows you to ride out market fluctuations. It can help in achieving significant growth over time.

Avoiding Emotional Decisions

Emotions can cloud your judgment. Fear and greed often lead to poor choices. A long-term perspective helps you stay calm during market dips. It reduces the urge to sell in panic. Instead, you can focus on the bigger picture. This approach can protect your investments from unnecessary losses.

Focusing On Growth

Long-term investing prioritizes growth. It looks beyond short-term gains. You invest in companies with strong potential. These companies may face ups and downs. But over time, they can deliver substantial returns. This focus on growth helps you build wealth steadily. It minimizes the impact of market volatility.

credit: www.fastercapital.com

Regular Monitoring

Regular monitoring is crucial to avoid losses in the stock market. It involves keeping a close eye on your investments. This helps in making informed decisions. Regular monitoring you stay updated with market trends. It allows you to act if needed. Now, let’s go into some key aspects of regular monitoring.

Tracking Performance

Tracking performance is essential. It shows how well your stocks are doing. Use reliable tools to track stock prices. Check your portfolio regularly. This helps in identifying profitable stocks. It helps in spotting underperforming ones.

Set specific goals for your investments. Compare the actual performance with these goals. This helps in understanding if your strategy is working. If not, you can take timely action. Staying informed helps in making better decisions.

Adjusting Strategies

Adjusting strategies is part of regular monitoring. The stock market is dynamic. Strategies that worked before may not work now. Be flexible with your investment plans. Review your strategies periodically.

If a stock is not performing well, consider selling it. Invest in stocks that show potential growth. Diversify your investments. This reduces risk. Keep an eye on market news. It can impact your investment strategies.

To make these adjustments effectively, having access to the right tools is essential. Platforms for stock analysis can provide you with the data and insights needed to make informed decisions about buying, selling, and adjusting your portfolio. If you’re looking for a reliable platform to analyze stocks, check out this review on Which Platform Is Best for Stock Analysis?.

Regular monitoring and adjusting strategies go hand in hand. It helps in minimizing losses. It maximizes potential gains.

Professional Advice

Professional Advice is crucial in minimizing losses in the stock market. Avoid Losses Stock Market Expert guidance can help you make informed decisions, reducing the risk of financial setbacks. Below are some key strategies to consider when seeking professional advice.

Consulting Financial Advisors

Financial advisors offer personalized strategies tailored to your financial goals. Their experience can help you navigate market fluctuations. Here are some advantages:

- They conduct thorough market analysis.

- They provide diversified investment options.

- They offer ongoing portfolio management.

Consulting a financial advisor you are making well-informed decisions. They help you avoid common pitfalls that lead to losses.

Utilizing Investment Tools

Investment tools can greatly assist in managing your portfolio. These tools offer real-time data and predictive analytics. Here are some popular investment tools:

| Tool | Features |

|---|---|

| Robo-advisors | Automated portfolio management |

| Stock screeners | Filter stocks based on criteria |

| Trading platforms | Real-time market data |

Using these tools helps in making data-driven decisions. This reduces the risk of emotional trading, which can lead to losses.

Credit: www.fool.com

Frequently Asked Questions

How Can I Minimize Stock Market Losses?

To minimize Avoid Losses Stock Market ,diversify your investments. Research thoroughly before investing. Set stop-loss orders to limit potential losses.

What Are Stop-loss Orders?

Stop-loss orders automatically sell a stock when it reaches a certain price. This limits your losses and protects your investment.

Should I Diversify My Stock Portfolio?

Yes, diversifying your stock portfolio reduces risk. Spread your investments across different sectors to avoid significant losses.

How Important Is Market Research?

Market research is crucial for informed decisions. It helps identify trends and potential risks, improving your chances of avoiding losses.

Conclusion

Avoiding losses in the stock market takes discipline and knowledge. Start with research. Understand your investments. Diversify your portfolio to spread risk. Set clear goals and stick to them. Monitor your investments regularly. Stay patient and avoid panic selling. Learn from your mistakes.

Stay informed about market trends. These steps can help you navigate the stock market more confidently. Remember, smart investing is a journey. Stay focused, stay calm, and make informed decisions.

If you’re new to investing and looking for a structured approach to getting started, a good first step is to learn the basics. For a comprehensive guide on how to begin your stock market journey, check out this article on How to Invest in the Stock Market for the First Time: A Beginner’s Guide.