Small businesses face many challenges, especially in managing finances. Invoicing, expense tracking, and time management can be overwhelming.

Enter Billed, a comprehensive financial management tool tailored for small businesses. Designed to streamline invoicing, estimates, expense tracking, and time tracking, Billed helps small businesses get paid faster. Customizable invoices, automatic calculations, and recurring invoices efficient billing processes. With features like time tracking and expense management, Billed offers precision and ease. It supports online payments and integrates with popular platforms like PayPal and Stripe. Whether accessing through a mobile app or web, Billed provides flexibility and collaboration for teams. Explore how Billed can transform your financial management and boost your business efficiency. For more details, visit the Billed for small businesses page.

credit: www.billdu.com

Introduction To Billed For Small Businesses

Managing finances can be challenging for small businesses. Billed offers a comprehensive solution to simplify invoicing, expense tracking, and time management, helping businesses get paid faster and more efficiently.

What Is Billed?

Billed is an all-in-one financial management tool designed specifically for freelancers and small businesses. It combines various features like customizable invoices, expense tracking, and project management in one platform.

| Features | Details |

|---|---|

| Customizable Invoices | Use professional templates with attachments, signature fields, and notes. |

| Automatic Calculations | Automatically calculate taxes and discounts. |

| Recurring Invoices | Set up and send payment reminders for a steady cash flow. |

| Online Payments | Accept flexible payment options, including partial payments. |

| Time Tracking | Track time spent on tasks and projects. |

| Collaborative Billing | Invite teammates to log their time for collaborative projects. |

| Expense Tracking | Track project expenses, factor in taxes, and mark up expenses. |

| Estimates | Create, customize, and convert estimates to invoices. |

| OCR Technology | Scan receipts to extract info and reduce manual data entry. |

| Mobile and Web App | Access through mobile app, web app, and Chrome extension. |

| Integrations | Supports PayPal, Stripe, Mollie, Square, and Zapier. |

credit: www.medium.com

credit: www.medium.com

Purpose And Importance Of Invoicing For Small Businesses

Invoicing is critical for small businesses. It timely payments and maintains cash flow. Billed helps create professional invoices that reflect your brand.

With automatic calculations, you minimize errors and save time. Recurring invoices and payment reminders keep the cash flow steady. This reduces the risk of late payments.

Offering multiple payment options makes it easier for clients to pay. This flexibility can lead to quicker payments.

Collaborative billing is essential for team projects. It allows team members to log their hours, ensuring accurate billing.

Expense tracking is another key feature. It helps businesses keep an eye on project costs. This expenses are tracked and managed efficiently.

Overall, Billed offers a holistic approach to managing invoices and payments. It is a must-have tool for small businesses aiming for efficiency and accuracy.

Key Features Of Billed

Billed is designed to make financial management easy for freelancers and small businesses. This tool offers a range of features to streamline invoicing, expense tracking, and project management, ensuring you get paid faster. Simplify billing for freelancers with Billed’s powerful features. Explore the key features of Billed below.

The user-friendly interface of Billed that you can navigate and use the tool with ease. The intuitive design helps you manage your finances without any hassle, even if you have no prior experience with financial management software.

Billed offers customizable invoice templates that help you create professional invoices. You can add attachments, signature fields, and notes to your invoices. This customization allows you to tailor each invoice to your client’s specific needs.

With Billed, you can set up automated reminders for your recurring invoices. This feature you maintain a steady cash flow by reminding your clients about upcoming payments. You can focus on other tasks while Billed handles the reminders.

Billed offers robust expense tracking capabilities. Track your project expenses, factor in taxes, and mark up expenses easily. The tool includes OCR technology to scan receipts and extract information, reducing manual data entry.

Billed supports multiple currencies, making it easier for you to manage international clients. This feature accurate invoicing and payment processing, regardless of the currency your clients use.

Billed integrates with various payment gateways, including PayPal, Stripe, Mollie, Square, and Zapier. These integrations allow you to accept flexible payment options, including partial payments, ensuring that you get paid faster.

| Feature | Description |

|---|---|

| User-Friendly Interface | Easy navigation and intuitive design. |

| Customizable Invoice Templates | Create professional invoices with attachments and notes. |

| Automated Reminders | Set up reminders for recurring invoices. |

| Expense Tracking | Track expenses, factor in taxes, and use OCR technology. |

| Multi-Currency Support | Manage international clients with ease. |

| Integration with Payment Gateways | Support for PayPal, Stripe, Mollie, and more. |

credit: www.geeksforgeeks.org

User-friendly Interface

Billed offers a user-friendly interface that simplifies financial management for small businesses. The platform is designed to be intuitive, ensuring users can navigate and manage their finances effortlessly.

Ease Of Navigation

Billed’s interface is easy to navigate, making it simple for users to find the tools they need. With clear menus and straightforward options, users can quickly access invoicing, expense tracking, time tracking, and other essential features.

- Intuitive design for quick access

- Clear and concise menus

- Simplified options for ease of use

Dashboard Overview

The Billed dashboard provides a comprehensive overview of your financial activities. It displays key information in an organized manner, allowing users to monitor their business at a glance.

| Feature | Description |

|---|---|

| Customizable Invoices | Professional templates with attachments, signature fields, and notes |

| Automatic Calculations | Automatically calculate taxes and discounts |

| Recurring Invoices | Set up and send payment reminders for steady cash flow |

| Online Payments | Accept flexible payment options, including partial payments |

With Billed, small businesses can manage their finances efficiently. The user-friendly interface tasks are completed quickly and accurately.

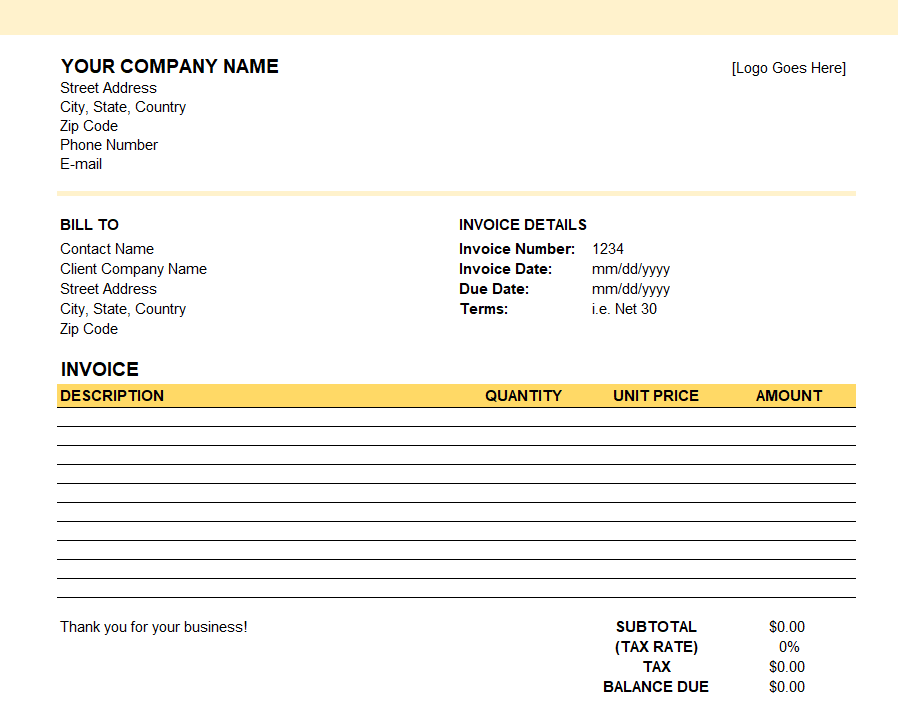

Customizable Invoice Templates

Creating invoices can be a tedious task for small businesses. With Billed, you can simplify the process using customizable invoice templates. These templates help you create professional and personalized invoices quickly.

Personalization Options

Billed offers various personalization options to make your invoices unique. You can add your business logo, choose colors that match your brand, and include custom fields. This every invoice reflects your business identity.

- Business Logo

- Brand Colors

- Custom Fields

- Attachments

- Signature Fields

- Notes

Professional Appearance

A professional appearance is crucial for invoices. Billed provides templates that your invoices look polished and credible. These templates are designed to include all necessary details, such as client information, itemized lists, and payment terms.

| Feature | Benefit |

|---|---|

| Client Information | clarity in billing |

| Itemized Lists | Breaks down services/products |

| Payment Terms | Sets clear expectations |

By using Billed’s customizable templates, your small business can maintain a professional image, making it easier to get paid faster and accurately.

Automated Reminders

One of the standout features of Billed for small businesses is the Automated Reminders. This tool helps that invoices are paid on time, reducing the administrative burden on business owners. Let’s explore how automated reminders can benefit your business.

Reducing Late Payments

Late payments can significantly impact cash flow. With Billed’s Automated Reminders, you can set up reminders to notify clients about upcoming or overdue payments. This proactive approach helps in reducing the chances of late payments.

Here are some key benefits:

- Timely Notifications: Clients receive regular notifications before and after the due date.

- Professional Templates: Use professional templates to maintain a consistent and professional communication style.

- Customizable Messaging: Tailor your messages to match your brand’s voice and tone.

Saving Time

Manually tracking and sending payment reminders can be time-consuming. Billed’s Automated Reminders streamline this process, saving you valuable time.

Take these advantages:

- Automated Process: Set reminders once and let the system handle the rest.

- Focus on Growth: Spend less time chasing payments and more time growing your business.

- Efficient Workflow: Integrate reminders with other Billed features like Recurring Invoices and Expense Tracking for a seamless workflow.

Using Billed’s Automated Reminders not only timely payments but overall efficiency, allowing small businesses to thrive.

For more details, visit the Billed product page.

Expense Tracking

Expense tracking is crucial for small businesses. It helps manage finances efficiently. Billed offers an excellent solution for this need. This all-in-one financial management tool simplifies and streamlines expense tracking.

Simplifying Financial Management

Billed simplifies financial management with its user-friendly interface. You can easily track project expenses. The tool allows you to factor in taxes and mark up expenses. This accurate financial records.

Using Billed, you can scan receipts with OCR Technology. This reduces manual data entry. The tool automatically extracts information from receipts. This saves time and minimizes errors.

Real-time Expense Monitoring

Billed provides real-time expense monitoring. You can access expense data anytime. This is possible through the mobile app, web app, and Chrome extension. You can monitor expenses on the go.

The tool supports integrations with PayPal, Stripe, Mollie, Square, and Zapier. These integrations seamless expense tracking. You can easily manage payments and expenses within one platform.

| Feature | Description |

|---|---|

| OCR Technology | Scan receipts to reduce manual data entry |

| Integrations | Supports PayPal, Stripe, Mollie, Square, and Zapier |

| Access | Mobile app, web app, and Chrome extension |

With Billed, expense tracking becomes effortless. You can accurate and up-to-date financial records. This helps small businesses stay on top of their finances.

Multi-currency Support

Billed offers robust multi-currency support for small businesses, helping them operate globally with ease. This feature that businesses can manage transactions in various currencies, simplifying financial operations and client satisfaction.

Global Business Operations

With Billed’s multi-currency support, small businesses can expand their global reach. They can easily invoice clients in their preferred currencies, facilitating smoother international transactions. This flexibility is crucial for businesses aiming to tap into diverse markets.

Here are some key benefits:

- Invoice clients in multiple currencies

- Improve client relationships with localized billing

- Expand market reach effortlessly

Exchange Rate Management

Billed simplifies exchange rate management by automatically calculating and applying the latest rates. This accurate invoicing and financial reporting.

Key features include:

- Automatic exchange rate updates

- Accurate financial reporting

- Reduced manual calculations

Here’s a quick overview of how it works:

| Feature | Description |

|---|---|

| Automatic Updates | Exchange rates updated automatically to accuracy. |

| Accurate Invoicing | Invoices reflect the correct currency exchange rates. |

| Financial Reports | Reports include accurate currency conversions. |

These features that small businesses can operate seamlessly on a global scale with Billed.

Credit: www.waveapps.com

Integration With Payment Gateways

Billed offers seamless integration with popular payment gateways, the payment process for small businesses. This feature that businesses can easily accept payments online, reducing manual efforts and speeding up transactions. Let’s explore how this integration works and its benefits.

Streamlining Payments

Billed integrates with major payment gateways like PayPal, Stripe, Mollie, and Square. This integration allows businesses to manage payments efficiently. By connecting your Billed account with these gateways, you can automate the payment process.

- Receive payments directly into your bank account.

- Automatic tax and discount calculations.

- Send payment reminders for overdue invoices.

These features save time and accuracy in financial transactions. It reduces the need for manual entries and minimizes errors.

Variety Of Options

Businesses can choose from a variety of payment options. Billed supports multiple payment methods to cater to diverse client preferences.

| Payment Gateway | Supported Methods |

|---|---|

| PayPal | Credit/Debit Cards, PayPal Balance |

| Stripe | Credit/Debit Cards, ACH Transfers |

| Mollie | SEPA, iDEAL, Credit Cards |

| Square | Credit/Debit Cards |

Offering multiple payment options increases the likelihood of timely payments. Clients can choose the method that suits them best, ensuring a smooth transaction process.

Integrating with these gateways the security of transactions. Each gateway adheres to strict security standards, protecting both the business and the client.

Billed’s integration with payment gateways is designed to make the payment process simple, secure, and efficient for small businesses.

Pricing And Affordability

Billed offers a range of pricing tiers designed to suit the needs of small businesses and freelancers. The plans are affordable and come with a host of features to simplify invoicing, expense tracking, and project management.

Pricing Tiers

| License Tier | Price | Features |

|---|---|---|

| License Tier 1 | $49 (originally $250) | 3 team members, 1 workspace |

| License Tier 2 | $149 (originally $500) | 10 team members, 5 workspaces |

| License Tier 3 | $249 (originally $799) | Unlimited team members, 10 workspaces |

| License Tier 4 | $499 (originally $1,399) | Unlimited team members, unlimited workspaces |

All plans include unlimited invoices and estimates, expense tracking, time tracking, and financial reports.

Value For Money

Billed offers significant value for its price. The Lifetime Deal a one-time payment for lifetime access, saving you from recurring costs. Each plan includes essential features like:

- Customizable Invoices: Use professional templates.

- Recurring Invoices: Set up and send payment reminders.

- Online Payments: Accept flexible payment options.

- Time Tracking: Track time spent on tasks and projects.

- Expense Tracking: Factor in taxes and mark up expenses.

Billed supports integrations with PayPal, Stripe, Mollie, Square, and Zapier, its functionality. With a 60-day money-back guarantee, you can try Billed risk-free.

Credit: www.etsy.com

Pros And Cons Based On Real-world Usage

Billed offers numerous features to simplify financial management for small businesses and freelancers. Understanding the pros and cons based on real-world usage helps in making an informed decision.

Pros: Efficiency And Time-saving

Billed efficiency and saves time through its automated processes. It helps small businesses streamline their invoicing, expense tracking, and project management tasks.

- Customizable Invoices: Create professional invoices with templates, attachments, and signature fields.

- Automatic Calculations: Automatically apply taxes and discounts, reducing manual errors.

- Recurring Invoices: Set up recurring invoices and payment reminders for steady cash flow.

- Time Tracking: Track time spent on tasks, ensuring accurate billing.

- Expense Tracking: Monitor project expenses and apply taxes accurately.

- OCR Technology: Scan receipts to reduce manual data entry.

- Integrations: Supports PayPal, Stripe, Mollie, Square, and Zapier.

These features contribute to significant time savings and improved accuracy in financial management.

Cons: Potential Drawbacks

While Billed offers many advantages, there are a few potential drawbacks that users have reported.

- Learning Curve: Some users find the initial setup and learning process challenging.

- Limited Mobile Functionality: Although Billed has a mobile app, certain advanced features may be more accessible on the web app.

- Cost: The pricing tiers can be a concern for very small businesses with limited budgets.

Despite these drawbacks, the benefits often outweigh the negatives, making Billed a valuable tool for managing business finances efficiently.

Ideal Users And Scenarios

Billed is a powerful tool designed to simplify invoicing, expense tracking, and time management. It’s perfect for freelancers and small business owners. Below, we explore the ideal users and scenarios where Billed can be most effective.

Best Suited For Freelancers And Small Business Owners

Billed caters to the needs of both freelancers and small business owners. Its features offer flexibility and efficiency, making it an ideal choice.Simplify billing for freelancers with Billed and take control of your financial management.

- Freelancers: Manage multiple clients and projects seamlessly.

- Small Business Owners: Streamline financial processes for better cash flow.

Freelancers benefit from customizable invoices, time tracking, and expense management. Small business owners appreciate recurring invoices, collaborative billing, and detailed financial reports.

Scenarios For Optimal Use

Billed shines in various scenarios, ensuring users get the most out of its features.

- Project-Based Work: Track time and expenses, then invoice clients accurately.

- Recurring Services: Set up recurring invoices for consistent revenue.

- Client Retainers: Manage retainers with flexible payment options and reminders.

Project-based work benefits from time tracking and detailed invoicing. Recurring services steady cash flow with automated invoices. Client retainers become easier to manage with flexible payment and reminders.

| Feature | Benefit | Ideal For |

|---|---|---|

| Customizable Invoices | Professional templates and attachments | Freelancers, Small Business Owners |

| Recurring Invoices | Automated payment reminders | Service-Based Businesses |

| Time Tracking | Accurate billing for hours worked | Freelancers, Project-Based Work |

| Expense Tracking | Monitor and invoice project expenses | All Users |

Billed supports integrations with PayPal, Stripe, Mollie, Square, and Zapier. This flexibility and simplifies payment processing. Use the mobile app or web app to manage finances on the go.

Credit: altline.sobanco.com

Frequently Asked Questions

What Is Invoicing For Small Businesses?

Invoicing for small businesses is the process of billing clients for products or services. It timely payments and financial tracking.

How Can Small Businesses Create Invoices?

Small businesses can create invoices using software tools like QuickBooks or manually with templates. Digital tools offer efficiency and accuracy.

Why Are Timely Invoices Important?

Timely invoices faster payments and maintain cash flow. They help build professional relationships with clients by showing reliability.

What Should An Invoice Include?

An invoice should include business name, contact details, itemized list, prices, total amount, and payment terms. Clear details prevent misunderstandings.

Conclusion

Billed offers a comprehensive solution for small businesses and freelancers. It simplifies invoicing, expense tracking, and project management. Save time and accuracy with automated features and detailed tracking. Collaborate easily with teammates and manage multiple payment options.Explore how to simplify billing for freelancers with Billed and improve your financial management today. Explore Billed here.