Choosing the right software tool for bookkeeping is crucial. It helps manage your finances effectively.

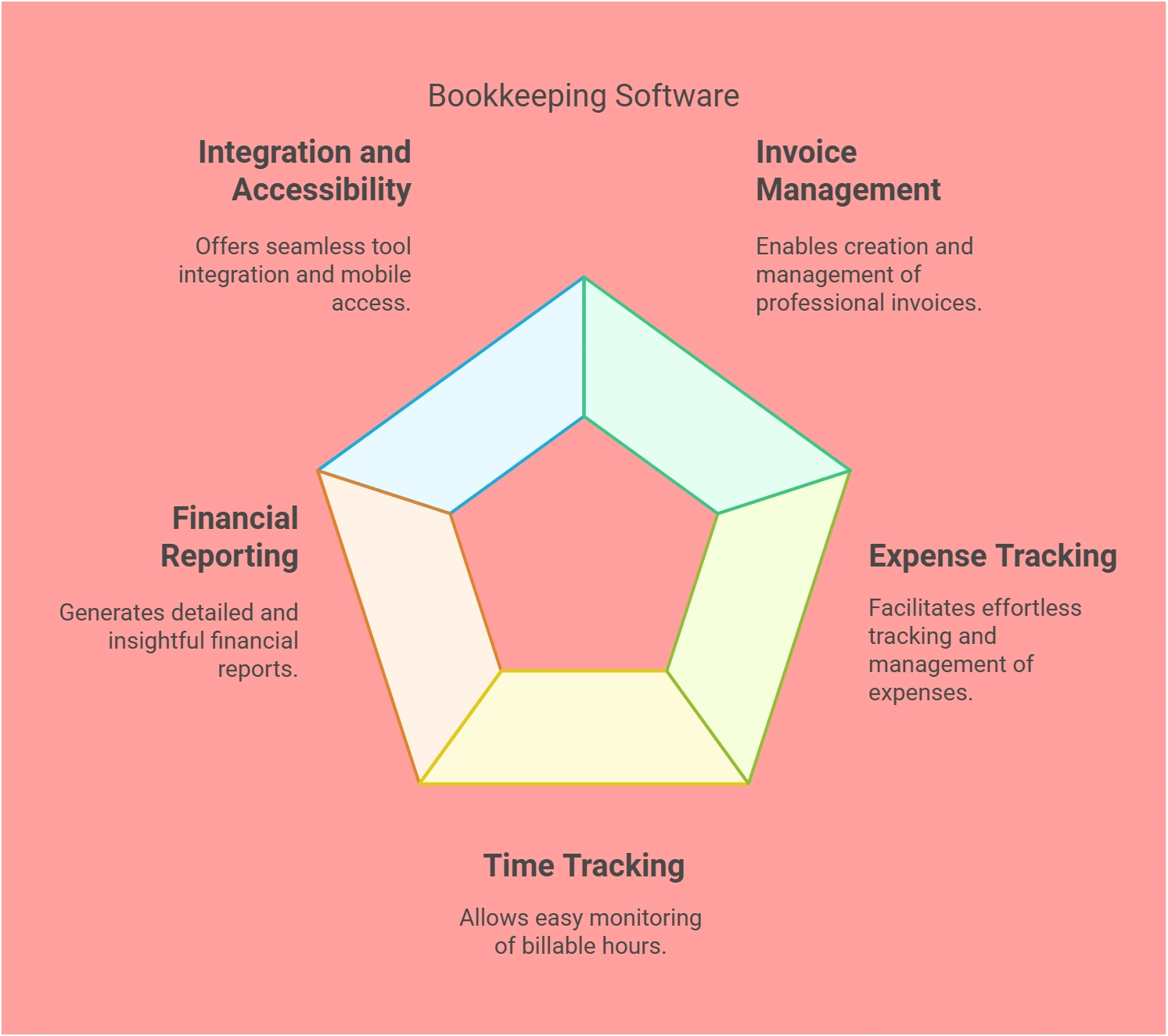

So, what is the best software tool for bookkeeping? FreshBooks stands out as a top choice for many small businesses and freelancers. It’s designed to be user-friendly, making financial tasks easier even for non-accountants. FreshBooks offers a range of features including invoicing, expense tracking, time tracking, payment processing, and financial reporting. Software Tool Bookkeeping These tools help you manage your business finances efficiently. FreshBooks integrates well with other software, making it a versatile option for various professional fields. Plus, with mobile apps, you can handle your bookkeeping tasks on the go. Learn more about FreshBooks and see if it’s the right fit for your needs by visiting their official website. For a detailed guide, check out this link.

credit: www.tranquibs.com

Introduction To Bookkeeping Software

In today’s fast-paced business world, keeping track of finances is crucial. Bookkeeping software simplifies this by automating financial tasks. It helps businesses manage invoices, track expenses, and generate financial reports. One such tool is FreshBooks, designed for small businesses and freelancers. It is user-friendly and offers a suite of features tailored for non-accountants.

What Is Bookkeeping Software?

Bookkeeping software is an application that helps businesses manage their financial records. It automates tasks such as invoicing, expense tracking, and payroll. This software accuracy in financial data and saves time. Software Tool Bookkeeping FreshBooks is a popular choice, known for its ease of use and comprehensive features.

Importance Of Bookkeeping Software In Today’s Business Environment

Using bookkeeping software is essential in today’s business environment. Software Tool Bookkeeping It simplifies complex accounting tasks and accuracy. FreshBooks, for instance, offers features like:

- Invoice Software: Create and manage professional invoices.

- Expenses and Receipts: Track and manage expenses effortlessly.

- Time Tracking: Monitor billable hours with ease.

- Financial Reports: Generate detailed financial reports.

These features help businesses stay organized and efficient. FreshBooks integrates with other tools, providing seamless functionality. Its mobile app accessibility on the go, making it a versatile choice for modern businesses.

| Feature | Description |

|---|---|

| Invoice Software | Create, send, and manage professional invoices. |

| Expenses and Receipts | Track expenses and manage receipts effortlessly. |

| Time Tracking | Monitor billable hours with ease. |

| Financial Reports | Generate detailed financial reports. |

With FreshBooks, businesses can focus on growth while the software handles financial tasks. Its user-friendly interface that even non-accountants can use it efficiently.

Top 5 Bookkeeping Software Tools

Choosing the right bookkeeping software can streamline your financial management. Here are the top 5 bookkeeping software tools to help manage your finances effectively.

Credit: www.clinked.com

Overview Of The Selection Criteria

Our selection criteria focus on user-friendliness, features, pricing, customer support, and integration capabilities. These factors the software meets the needs of small businesses, freelancers, and accountants.

Brief Introduction To Each Tool

| Tool | Key Features | Target Audience |

|---|---|---|

| FreshBooks |

|

|

| QuickBooks |

|

|

| Xero |

|

|

| Wave |

|

|

| Zoho Books |

|

|

Tool #1: Quickbooks

QuickBooks is a widely-used bookkeeping software designed to help small businesses and freelancers manage their finances efficiently. Software Tool Bookkeeping It offers a variety of features that streamline accounting tasks, making it easier for users to stay on top of their financial health.

Key Features And Benefits

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Keep track of all your business expenses.

- Bank Reconciliation: Automatically reconcile your bank transactions.

- Payroll Management: Manage payroll and employee benefits.

- Financial Reporting: Generate detailed financial reports.

- Time Tracking: Track billable hours with ease.

- Mobile App: Access your data on the go.

Pricing And Affordability

| Plan | Monthly Cost | Features |

|---|---|---|

| Simple Start | $25 | Basic features for small businesses. |

| Essentials | $50 | Includes additional features for growing businesses. |

| Plus | $80 | Advanced features for established businesses. |

| Advanced | $180 | Comprehensive features for large businesses. |

Pros And Cons

- Pros:

- User-friendly interface.

- Comprehensive feature set.

- Excellent customer support.

- Scalable for business growth.

- Integration with other software.

- Cons:

- Higher cost for premium plans.

- Learning curve for new users.

Ideal Users And Scenarios

QuickBooks is ideal for:

- Small businesses needing robust bookkeeping tools.

- Freelancers looking for easy invoicing and expense tracking.

- Growing businesses requiring scalable accounting solutions.

- Businesses needing payroll management.

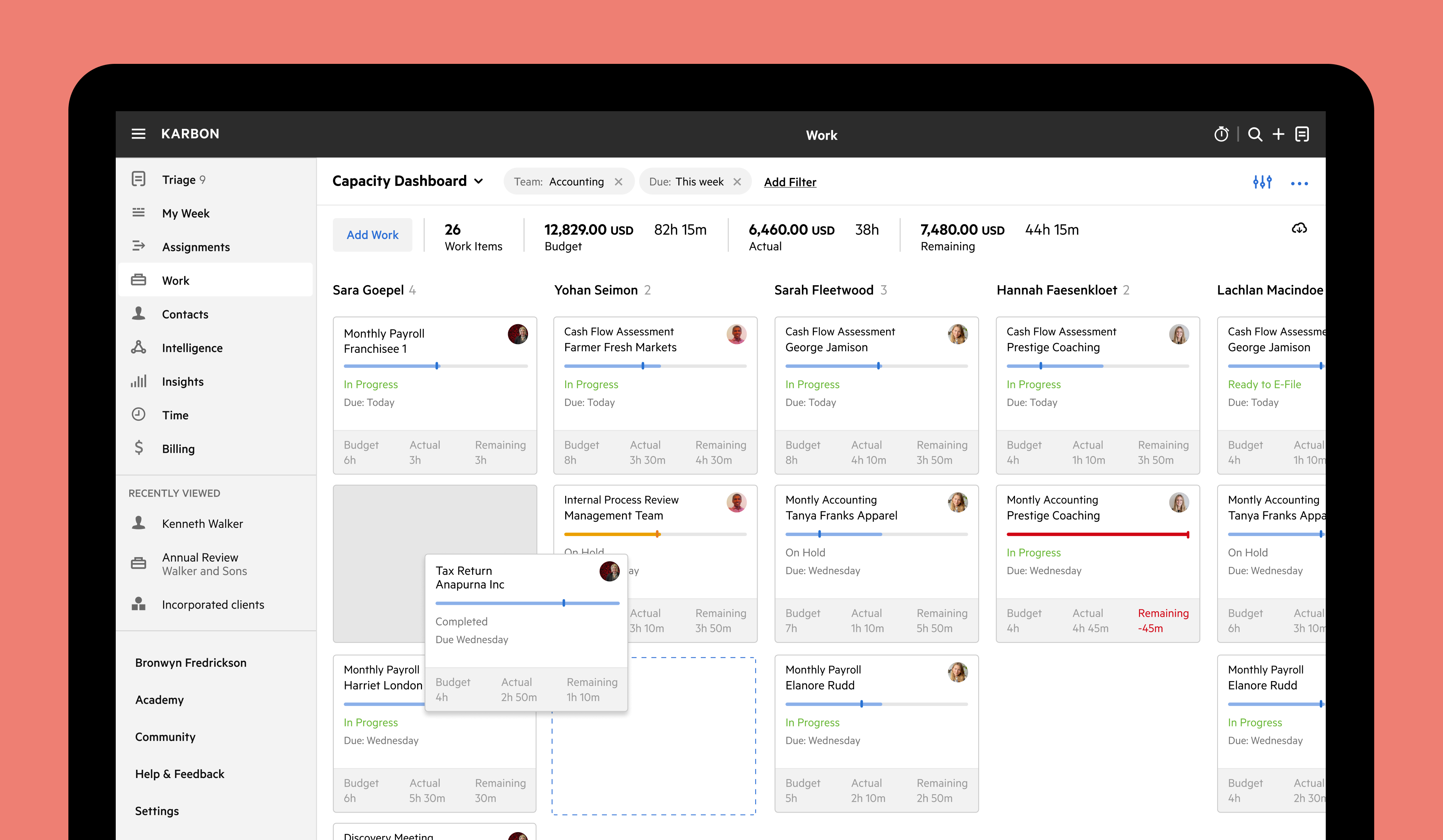

Credit: karbonhq.com

Tool #2: Xero

Xero is a popular bookkeeping software designed for small businesses. It offers a variety of tools to help manage your financial activities efficiently. Xero’s user-friendly interface and powerful features make it an excellent choice for many users.

Key Features And Benefits

- Bank Reconciliation: Automatically import and categorize bank transactions.

- Invoicing: Create, send, and track invoices easily.

- Expense Tracking: Manage expenses and receipts effortlessly.

- Inventory Management: Track inventory and stock levels.

- Payroll: Simplify payroll processes and compliance.

- Multi-Currency: Handle transactions in multiple currencies.

- Mobile Access: Access all features via mobile apps.

- Integrations: Seamless integrations with other tools and software.

Pricing And Affordability

Xero offers several pricing plans to fit different business needs. Below is a table summarizing the pricing details:

| Plan | Price (per month) | Features |

|---|---|---|

| Starter | $20 | Limited invoices, bills, and bank transactions |

| Standard | $30 | Unlimited invoices, bills, and bank transactions |

| Premium | $40 | Includes multi-currency support |

Pros And Cons

Pros:

- Easy to use with a clean interface.

- Excellent customer support.

- Comprehensive financial reports.

Cons:

- Higher cost for premium features.

- Limited functionality in the starter plan.

Ideal Users And Scenarios

Xero is ideal for small to medium-sized businesses. It’s suitable for various industries such as retail, e-commerce, and professional services. Freelancers and contractors can benefit from its invoicing and expense tracking features.

Tool #3: Freshbooks

FreshBooks is a comprehensive accounting software designed to simplify financial tasks for small businesses, freelancers, and accountants. With features like invoicing, expense tracking, and time tracking, FreshBooks users can manage their finances with ease. Accessible through mobile apps, it’s tailored for non-accountants who need a user-friendly solution.

Key Features And Benefits

FreshBooks offers a rich suite of tools aimed at streamlining financial management:

- Invoice Software: Create, send, and manage professional invoices.

- Expenses and Receipts: Track expenses and manage receipts effortlessly.

- Accounting Software: Full-fledged accounting tools for financial management.

- Time Tracking: Monitor billable hours with ease.

- Managing Projects: Organize and manage projects efficiently.

- Estimating Software: Generate accurate estimates and quotes.

- Online Payments: Accept online payments from clients.

- Financial Reports: Generate detailed financial reports.

- Mobile Apps: Access all features on the go with mobile applications.

- High Volume Billing: Manage high volume billing needs.

Benefits:

- Ease of Use: Simplifies complex accounting tasks.

- Customization: Tailored for various professional fields including construction, IT, legal, and marketing.

- Integration: Seamlessly integrates with other software and tools.

- Accessibility: Available on mobile devices for remote access.

- Efficiency: Saves time with automated processes and detailed tracking.

Pricing And Affordability

FreshBooks offers flexible pricing options, making it affordable for various business sizes:

| Plan | Discount |

|---|---|

| End of Year Sale | 75% off for the first 3 months |

| Buy Now & Save | Special pricing available during promotional periods |

Pros And Cons

While FreshBooks offers many advantages, it’s essential to consider both sides:

- Pros:

- Easy to use for non-accountants

- Comprehensive feature set

- Mobile app access

- Customizable for various industries

- Cons:

- May be expensive for very small businesses

- Limited advanced accounting features

Ideal Users And Scenarios

FreshBooks is perfect for:

- Freelancers

- Businesses with contractors

- Self-employed professionals

- Accountants

- Consultants

- IT and technology firms

- Legal professionals

- Marketing agencies

- Creative professionals

With its user-friendly design and powerful features, FreshBooks is an excellent choice for managing finances efficiently.

Tool #4: Wave

Wave is a powerful and free accounting software tool designed for small businesses and freelancers. Its user-friendly interface makes it easy to manage your finances. Wave offers a comprehensive suite of tools, making bookkeeping simple and efficient.

Key Features And Benefits

- Free Software: Wave is entirely free to use, with no hidden charges.

- Invoicing: Create and send professional invoices in minutes.

- Expense Tracking: Track your expenses effortlessly with simple tools.

- Bank Connections: Connect your bank accounts for automatic transaction imports.

- Financial Reporting: Generate detailed financial reports to understand your business better.

- Receipt Scanning: Scan receipts to track and organize expenses.

- Payroll: Manage payroll for your employees with ease.

- Integrations: Seamlessly integrates with other tools and software.

Pricing And Affordability

Wave is free to use, making it an attractive choice for small businesses and freelancers. Additional services like payroll and payment processing are available at competitive rates.

| Service | Price |

|---|---|

| Accounting Software | Free |

| Payroll | Starts at $20/month |

| Payment Processing | 2.9% + 30¢ per transaction |

Pros And Cons

Pros:

- Completely free accounting software.

- User-friendly interface.

- Comprehensive financial tools.

- Seamless bank integrations.

Cons:

- Paid services for payroll and payment processing.

- Limited customer support options.

Ideal Users And Scenarios

Wave is ideal for:

- Freelancers who need simple, free accounting tools.

- Small businesses looking for cost-effective financial management.

- Businesses that prefer a user-friendly, easy-to-use interface.

Wave offers a great solution for businesses that want to save on accounting software costs while enjoying robust financial tools.

Tool #5: Zoho Books

Zoho Books is a powerful and user-friendly bookkeeping software. It helps small businesses manage their finances efficiently. Zoho Books offers a range of features to streamline financial tasks, making it a popular choice for many users.

Key Features And Benefits

- Automated Bank Feeds: Connects to your bank and imports transactions automatically.

- Invoicing: Create and send professional invoices to clients.

- Expense Tracking: Track and categorize expenses effortlessly.

- Time Tracking: Monitor billable hours for accurate invoicing.

- Inventory Management: Manage your stock and inventory with ease.

- Multi-Currency Support: Handle transactions in multiple currencies.

- Financial Reporting: Generate detailed financial reports for better insights.

- Mobile Apps: Access all features on the go with mobile applications.

Pricing And Affordability

Zoho Books offers various pricing plans to suit different business needs:

| Plan | Price (per month) | Features |

|---|---|---|

| Basic | $9 | Includes invoicing, expense tracking, and bank reconciliation. |

| Standard | $19 | All Basic features plus project management and time tracking. |

| Professional | $29 | All Standard features plus inventory management and purchase orders. |

Pros And Cons

- Pros:

- Comprehensive feature set.

- User-friendly interface.

- Affordable pricing plans.

- Excellent customer support.

- Mobile app accessibility.

- Cons:

- Limited integrations compared to competitors.

- Advanced features may have a learning curve.

Ideal Users And Scenarios

Zoho Books is ideal for:

- Small business owners looking for affordable bookkeeping solutions.

- Freelancers needing easy invoicing and expense tracking.

- Businesses managing inventory and projects.

- Users requiring multi-currency support.

Overall, Zoho Books suits a variety of businesses. It offers a robust set of features at an affordable price.

Frequently Asked Questions

What Is The Best Bookkeeping Software For Small Businesses?

The best bookkeeping software for small businesses is QuickBooks. It offers user-friendly features and comprehensive tools. It helps manage finances efficiently.

Can Bookkeeping Software Save Time?

Yes, bookkeeping software can save time. It automates financial tasks and reduces manual data entry. This leads to increased productivity.

Is Quickbooks Suitable For Freelancers?

QuickBooks is suitable for freelancers. It offers tailored features for tracking income and expenses. It simplifies tax preparation.

Does Bookkeeping Software Offer Security?

Yes, bookkeeping software offers security. Most platforms use encryption and secure servers. This your financial data is protected.

Conclusion

Choosing the best software tool for bookkeeping can be challenging. FreshBooks stands out for its user-friendly interface and comprehensive features. It simplifies invoicing, expense tracking, time tracking, and payment processing. Perfect for small businesses and freelancers. FreshBooks offers mobile apps for on-the-go access. Discover more about FreshBooks and its features here. Simplify your bookkeeping tasks today with FreshBooks.